Best Time to Trade Forex: Understanding Forex Market Hours

Jul 18

One of the first things new Forex traders hear is that the market never sleeps.

The forex market, where people trade currencies like the U.S. dollar or euro, runs 24 hours a day, five days a week. But not every hour is great for trading. Knowing when the market is most active can help you make smarter trades and avoid costly mistakes.

Timing matters because liquidity and volatility change throughout the day. Busy hours often bring tighter spreads, clearer trends, and more reliable price moves. Quiet hours can feel slow and lead to wide price swings that hurt your account balance.

The forex market, where people trade currencies like the U.S. dollar or euro, runs 24 hours a day, five days a week. But not every hour is great for trading. Knowing when the market is most active can help you make smarter trades and avoid costly mistakes.

Timing matters because liquidity and volatility change throughout the day. Busy hours often bring tighter spreads, clearer trends, and more reliable price moves. Quiet hours can feel slow and lead to wide price swings that hurt your account balance.

If you want to catch the biggest price moves, avoid unnecessary risk, and get tighter spreads, timing your trades is just as important as knowing where to buy or sell. This guide breaks down how the Forex market’s hours work, when it’s busiest, which sessions overlap, and how to find the best time for you to trade.

What Are Forex Market Hours?

The forex market is open 24 hours a day, from Monday morning in Asia to Friday evening in New York. This is because currencies are traded all over the world, across different time zones. Unlike the stock market, which has set hours, forex never sleeps during the workweek. But not every hour is equal. The market is split into four major sessions based on big financial cities: Sydney, Tokyo, London, and New York. Each session has its own vibe, with different levels of activity and opportunities.

How the Forex Market Stays Open 24 Hours

Unlike stock markets, which open and close at set times, Forex rolls around the world. When traders in Sydney finish for the day, Tokyo is already active. When Tokyo slows down, London wakes up. Then New York joins in and keeps things moving until Sydney opens again.

This cycle means there’s always a market open somewhere. But the number of traders and the amount of money flowing in and out changes across these sessions. That’s why some times feel like a sleepy village, while others feel like a crowded stadium.

This cycle means there’s always a market open somewhere. But the number of traders and the amount of money flowing in and out changes across these sessions. That’s why some times feel like a sleepy village, while others feel like a crowded stadium.

Why Timing Matters

But “open all hours” does not mean “best all hours.” When a major financial center opens its doors, big banks and funds jump in. That drives higher volume and stronger price moves. At other times, you may face low liquidity and wide spreads.

Smart traders focus on hours when volume peaks. These windows often show clear trends and steady order flow. That makes it easier to buy, sell, and manage risk without getting chopped up by erratic price swings.

Smart traders focus on hours when volume peaks. These windows often show clear trends and steady order flow. That makes it easier to buy, sell, and manage risk without getting chopped up by erratic price swings.

Major Forex Trading Sessions

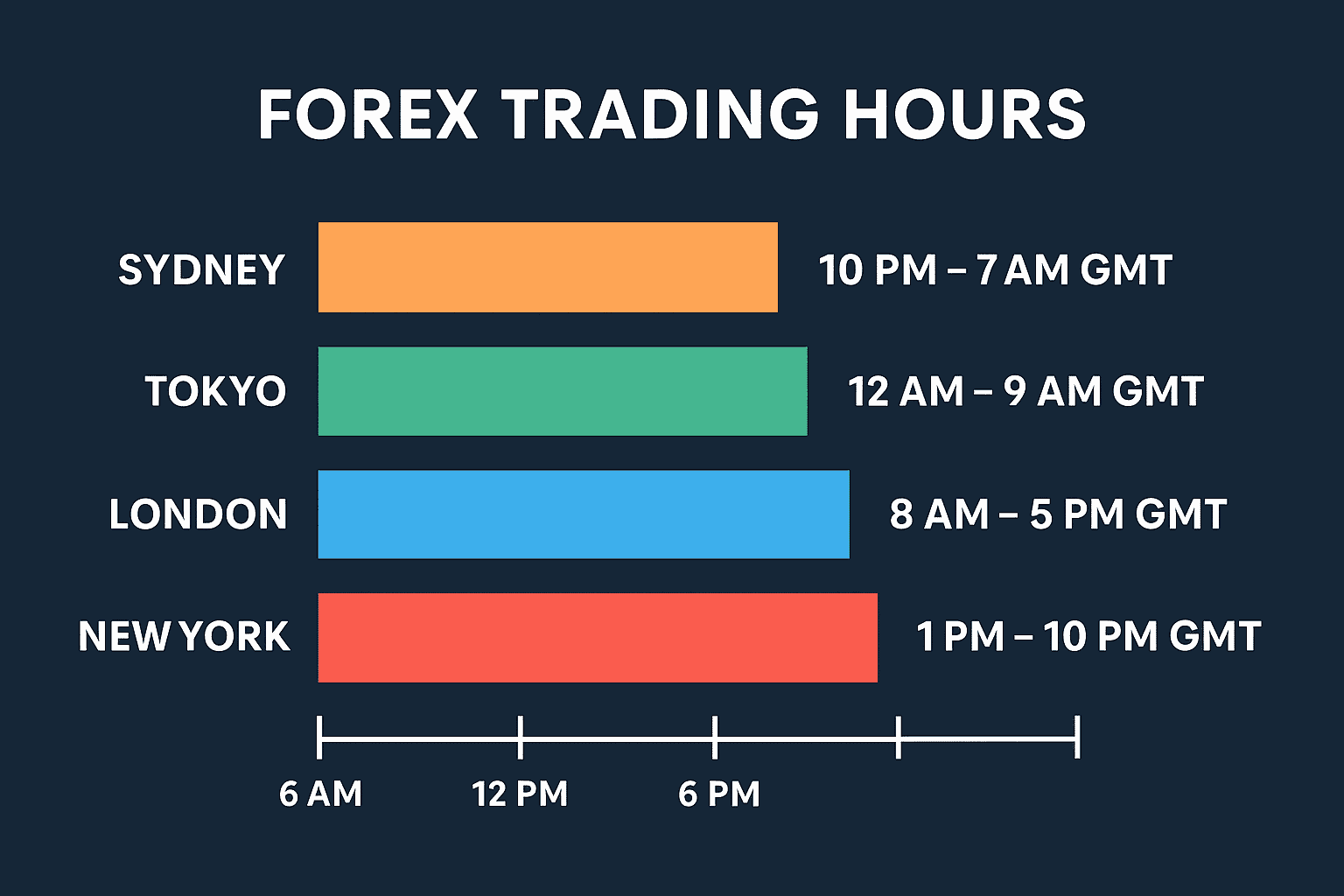

To understand when the market is most alive, you need to know the four key sessions. The forex day divides into four main sessions. Each session aligns with a global financial center. Here are the key windows:

- Sydney session

- Tokyo session

- London session

- New York session

Understanding these time blocks will help you pick the right moments to trade your favorite currency pairs.

Sydney Session

The Sydney session is the first to open for the trading week. It’s smaller than the others, but it sets the tone for Monday. Most trading during this time centers on the Australian and New Zealand dollars.

Typical active hours: 10:00 PM – 7:00 AM UTC

It’s a calm session with lower volume, but it can bring surprises if there’s big news out of Australia or New Zealand overnight.

Typical active hours: 10:00 PM – 7:00 AM UTC

It’s a calm session with lower volume, but it can bring surprises if there’s big news out of Australia or New Zealand overnight.

Tokyo Session (Asian Session)

After Sydney, the Tokyo session gets moving. Together, Sydney and Tokyo form what many traders call the “Asian Session.” Here, the Japanese yen takes the spotlight, along with pairs like USD/JPY and EUR/JPY.

Usual hours: 12:00 AM – 9:00 AM UTC

This session can see solid trends when Japanese banks and companies settle deals. Traders also watch China’s economic news at this time, which can move the market even if China’s own exchanges aren’t technically part of the Forex network.

Usual hours: 12:00 AM – 9:00 AM UTC

This session can see solid trends when Japanese banks and companies settle deals. Traders also watch China’s economic news at this time, which can move the market even if China’s own exchanges aren’t technically part of the Forex network.

London Session (European Session)

Next comes London, which is often called the powerhouse of Forex. The London session pulls the largest daily volume. Big banks, hedge funds, and institutions are very active, and traders worldwide watch what happens here.

Open time: 7:00 AM – 4:00 PM UTC

Pairs like GBP/USD and EUR/USD get the most attention. Because London overlaps with both Tokyo in the early hours and New York later, it sees the strongest moves and highest liquidity.

Open time: 7:00 AM – 4:00 PM UTC

Pairs like GBP/USD and EUR/USD get the most attention. Because London overlaps with both Tokyo in the early hours and New York later, it sees the strongest moves and highest liquidity.

New York Session (US Session)

The final major piece is the New York session. When New York opens, London is still running — this overlap creates the biggest wave of trading for the day. After London closes, New York keeps going alone for a few more hours.

Typical hours: 1:00 PM – 10:00 PM UTC

Most action centers on USD pairs, along with commodities like gold and oil which often move when US data comes out.

Typical hours: 1:00 PM – 10:00 PM UTC

Most action centers on USD pairs, along with commodities like gold and oil which often move when US data comes out.

Forex Market Hours in UTC/EST (12-hour clock)

Here are the major Forex sessions including Hong Kong and Singapore with their open and close times in both UTC and EST (UTC5):

Note: Daylight-saving time shifts can move these by ±1 hour.

| Trading Session | Opens (UTC) | Closes (UTC) | Opens (EST) | Closes (EST) |

| Sydney | 10:00 PM | 7:00 AM | 5:00 PM (prev day) | 2:00 AM |

| Tokyo | 12:00 AM | 9:00 AM | 7:00 PM (prev day) | 4:00 AM |

| Hong Kong | 1:00 AM | 10:00 AM | 8:00 PM (prev day) | 5:00 AM |

| Singapore | 1:00 AM | 10:00 AM | 8:00 PM (prev day) | 5:00 AM |

| London | 7:00 AM | 4:00 PM | 2:00 AM | 11:00 AM |

| York | 1:00 PM | 10:00 PM | 7:00 AM | 4:00 PM |

Note: Daylight-saving time shifts can move these by ±1 hour.

Best Times to Trade Forex

Now that you know the sessions, let’s talk about the best times to trade. The key is to find hours with high activity, tight spreads (the cost of trading), and good price movement. Here’s what you need to know.

Session Overlaps

The best trading times often happen when two sessions overlap, meaning more traders are active at once. There are two main overlaps to watch:

London-New York Overlap

(1:00 PM to 5:00 PM UTC):

This is the golden hour for forex trading. It lasts about four hours and is when you’ll often see major price swings. Big economic news, such as US job reports, usually drops during this time. It’s the busiest time, with the most trades and biggest price moves. Pairs like EUR/USD, GBP/USD, and USD/CHF are super active. Spreads are tight, so traders can get in and out without paying much extra.

This is the golden hour for forex trading. It lasts about four hours and is when you’ll often see major price swings. Big economic news, such as US job reports, usually drops during this time. It’s the busiest time, with the most trades and biggest price moves. Pairs like EUR/USD, GBP/USD, and USD/CHF are super active. Spreads are tight, so traders can get in and out without paying much extra.

Tokyo-London Overlap

(8:00 AM to 9:00 AM UTC):

This is shorter and less intense than the London–New York overlap but can still be interesting for pairs like EUR/JPY or GBP/JPY. Some trends start here and carry over into London’s full swing.

This is shorter and less intense than the London–New York overlap but can still be interesting for pairs like EUR/JPY or GBP/JPY. Some trends start here and carry over into London’s full swing.

When to Trade by Time of Day

Not all hours deliver equal opportunity. Here is a simple breakdown by local clock:

Early London often shows clear directional breaks. By midday U.S., major news hits and feeds into the ongoing trend or sparks reversals. Late Tokyo offers tight ranges for range-bound setups.

This is where traders learn to tell a breakout vs. fakeout, spotting if a strong move will hold or quickly reverse.

- Early London (8 AM–10 AM GMT): Trend formation and breakouts

- Midday U.S. (1 PM–4 PM GMT): Major economic news and high range

- Late Tokyo (7 AM–9 AM GMT): Quiet moves and fade strategies

Early London often shows clear directional breaks. By midday U.S., major news hits and feeds into the ongoing trend or sparks reversals. Late Tokyo offers tight ranges for range-bound setups.

This is where traders learn to tell a breakout vs. fakeout, spotting if a strong move will hold or quickly reverse.

Best Days to Trade Forex

Time of day isn’t the only factor, the day of the week matters too. While the market is open Monday through Friday, the level of action isn’t the same every day.

Monday’s morning can feel slow and erratic. Most traders wait for clear charts. From Tuesday through Thursday, markets are in full swing. By Friday afternoon, volume thins as traders lock in gains before the weekend.

- Monday: Market wakes up slowly with lower volumes

- Tuesday–Thursday: Peak activity and tight spreads

- Friday: Active early then slows near the close

| Day | Market Behavior | What Traders Should Know |

| Monday | Slow start, especially early in the Sydney and Tokyo sessions. | Traders often wait to see how the market reacts to news from the weekend. |

| Tuesday | Activity picks up — sessions have more volume and clearer trends begin to form. | Good day for day traders and swing traders to find opportunities. |

| Wednesday | Often the busiest day of the week with strong market moves. | Mid-week news releases and session overlaps can create big trends. |

| Thursday | Volume remains high; major trends often continue or reverse mid-week. | Good day for traders to ride or adjust positions before Friday’s closing swings. |

| Friday | Active in the London morning but slows down as traders close for the weekend. | Some traders avoid late-Friday trades to skip unexpected weekend gaps. |

Monday’s morning can feel slow and erratic. Most traders wait for clear charts. From Tuesday through Thursday, markets are in full swing. By Friday afternoon, volume thins as traders lock in gains before the weekend.

Start with Our Online Forex Courses

Our online courses at LITFX Academy are perfect for anyone wanting to dive into forex trading. We’ve designed them to be simple yet powerful.

Matching Trading Styles to Market Hours

Your strategy thrives in some sessions and struggles in others. Consider these pairings:

Day traders love the fast London–New York window. Scalpers find low spreads in Asian hours. Swing and position traders may prefer to load up near session opens, then ride momentum through its peak.

- Day trading: London–New York overlap for sharp breaks

- Scalping: Quiet Tokyo for tight-range fade plays

- Swing trading: Early London for trending entries and hold through New York

- Position trading: Midweek trends for multi-day holds

Day traders love the fast London–New York window. Scalpers find low spreads in Asian hours. Swing and position traders may prefer to load up near session opens, then ride momentum through its peak.

Factors to Consider When Choosing Trading Times

Picking the best time to trade isn’t just about market hours. Here are some things to think about to make your trading work for you.

Trading Style

Your trading style affects when you should trade. If you’re a scalper, meaning you make quick trades for small profits, the London-New York overlap is perfect because of its fast price moves. If you’re a swing trader, holding trades for days or weeks, quieter sessions like Sydney or Tokyo might suit you better. Think about how much time you can spend trading and how much risk you’re comfortable with.

Time Zone and Lifestyle

Your local time zone matters. If you’re in New York, the London-New York overlap (8:00 AM to 12:00 PM EST) is during your morning, which is convenient. But if you’re in Asia, that same overlap happens at night, which might not work for your schedule. Use a Forex Market Time Converter to see session times in your local time. This helps you plan trades around your daily life.

Risk Management

Trading during busy hours can be exciting but risky. Big price moves can lead to big wins or big losses. Always use stop-loss orders to limit how much you can lose on a trade. During quiet hours, like the Sydney session, you might face slippage, where your trade executes at a worse price than expected. Be cautious during low-volume times to avoid surprises.

2025-Specific Considerations

In 2025, daylight savings time will shift market hours in spring and fall. For example, in March and April, clocks in the U.S. and Europe move forward, changing session times by an hour. The same happens in October and November when clocks move back. Also, the forex market closes for holidays like Christmas and New Year’s, so plan around those days. Staying aware of these changes keeps your trading on track.

Quick Recap

- The Forex market runs 24 hours but liquidity changes through the day.

- Four major sessions: Sydney, Tokyo, London, and New York.

- Overlaps, especially London–New York, are the most active.

- Mid-week days usually see the strongest moves.

- Match your style to the right time: scalpers, day traders, and swing traders don’t all trade at once.

- Use tools and calendars to plan ahead.

- Build your plan around your best hours — not just the market’s.

LITFX Academy is the ultimate trading education platform, helping traders master Support & Resistance, refine risk management, and build confidence in the markets. Learn from real-world strategies, live coaching, and a thriving community of traders just like you!

Disclaimer: The content provided by LITFX Academy is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Trading involves risk, and past performance is not indicative of future results. Always do your own research and consult with a licensed financial professional before making any financial decisions.

Disclaimer: The content provided by LITFX Academy is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Trading involves risk, and past performance is not indicative of future results. Always do your own research and consult with a licensed financial professional before making any financial decisions.

© 2025 LITFX Academy. All Rights Reserved.