Base vs. Quote Currency: What's the Difference in Forex?

Aug 8

When you first hear the words forex trading, it might sound a little complicated. But a lot of it comes down to understanding just a few key ideas. One of the most important things to learn is how to read a currency pair. This might seem tricky at first because every single time you look at a currency, it’s always paired up with another one, like a two-person team. In every one of these teams, there are two main players: the base currency vs quote currency. Learning the difference between them is the first big step on your path to becoming a smart trader.

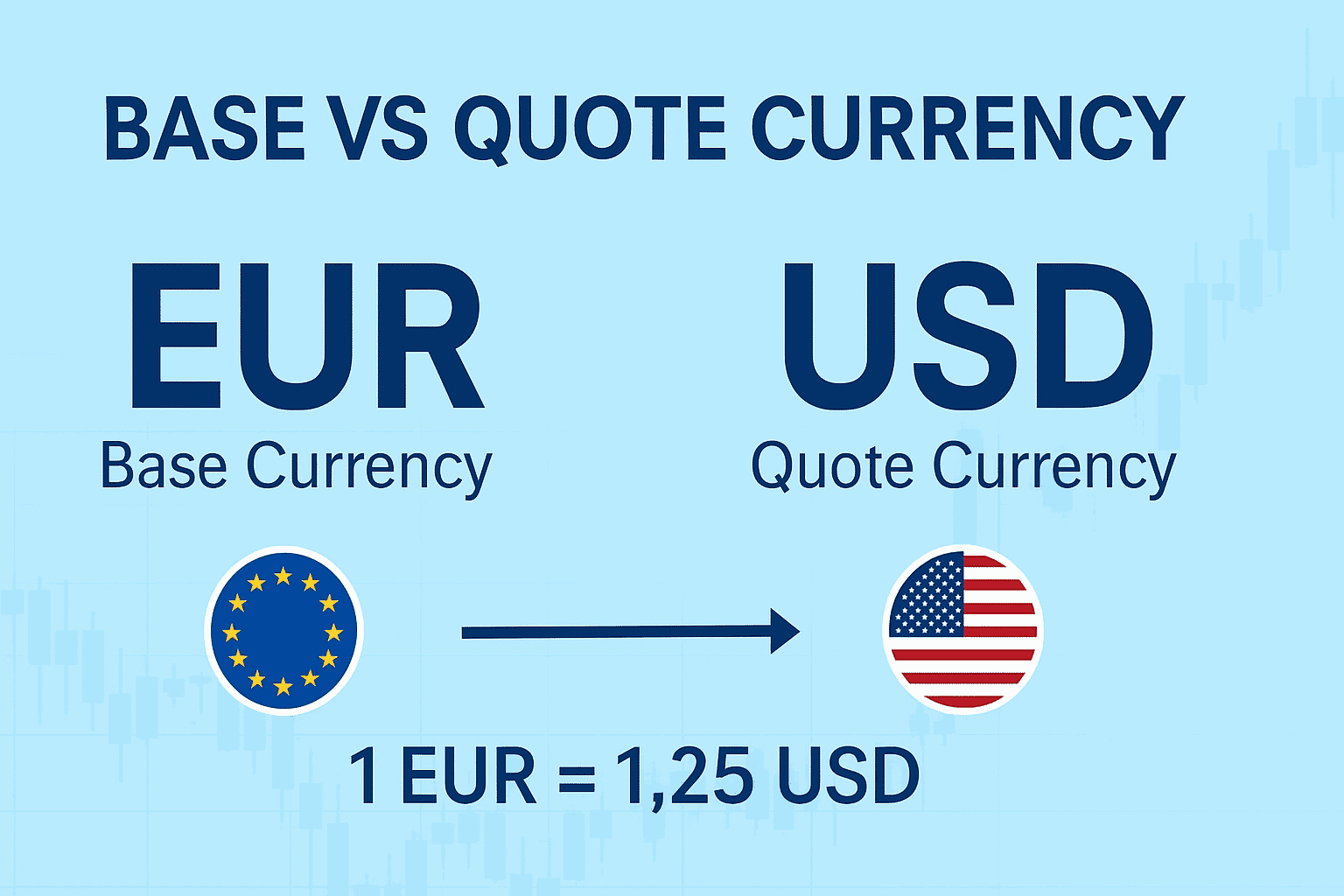

Difference Between Base and Quote Currency

The biggest and most important difference is their position and role in the currency pair. The base currency is the first currency in a forex pair, and it always has a value of one. The quote currency is the second currency, and its value shows how much of it you need to buy that one unit of the base currency. For example, in the pair EUR/USD, the Euro (EUR) is the base, and the U.S. Dollar (USD) is the quote. If the price is 1.10, it means you need $1.10 to buy €1. This simple rule is the foundation of all forex trading.

What is a Currency Pair?

Forex trading is all about exchanging one currency for another. But instead of saying, “I want to trade euros for US dollars”, traders use currency pairs to show this exchange in a clear, standard way.

Every currency pair has a three-letter code that is set by a global standard. For example, the U.S. Dollar is USD, and the Euro is EUR. When you see them together as EUR/USD, you know you are looking at the price of the Euro compared to the U.S. Dollar. There are many different currency pairs out there, but they all follow the same simple rule about which one is the base and which one is the quote.

We’ve talked a lot about currency pairs in our full guide, so check it out if you want to learn more!

Every currency pair has a three-letter code that is set by a global standard. For example, the U.S. Dollar is USD, and the Euro is EUR. When you see them together as EUR/USD, you know you are looking at the price of the Euro compared to the U.S. Dollar. There are many different currency pairs out there, but they all follow the same simple rule about which one is the base and which one is the quote.

We’ve talked a lot about currency pairs in our full guide, so check it out if you want to learn more!

What is the Base Currency?

The base currency is always the first one listed in a pair. Its job is to be the main point of focus. It is always worth exactly one unit. You are basically asking, "What is the price of one unit of this first currency?"

For example, in the currency pair EUR/USD, the Euro (EUR) is the base currency. This means that we are going to measure the price of one Euro using the second currency. It’s like the ruler we are using to make our measurement. The base currency is the foundation for every trade.

Let’s look at a few other examples to make sure this is clear:

In the pair USD/JPY, the U.S. Dollar (USD) is the base currency.

In the pair GBP/USD, the British Pound (GBP) is the base currency.

In the pair AUD/NZD, the Australian Dollar (AUD) is the base currency.

No matter what the pair is, the first currency always has a value of one. When you buy a currency pair, you are buying the base currency and selling the quote currency. The opposite is also true. When you sell a currency pair, you are selling the base currency and buying the quote currency. This is a very important part of how trades work.

For example, in the currency pair EUR/USD, the Euro (EUR) is the base currency. This means that we are going to measure the price of one Euro using the second currency. It’s like the ruler we are using to make our measurement. The base currency is the foundation for every trade.

Let’s look at a few other examples to make sure this is clear:

In the pair USD/JPY, the U.S. Dollar (USD) is the base currency.

In the pair GBP/USD, the British Pound (GBP) is the base currency.

In the pair AUD/NZD, the Australian Dollar (AUD) is the base currency.

No matter what the pair is, the first currency always has a value of one. When you buy a currency pair, you are buying the base currency and selling the quote currency. The opposite is also true. When you sell a currency pair, you are selling the base currency and buying the quote currency. This is a very important part of how trades work.

What is the Quote Currency?

Now for the other half of the pair. The quote currency is the second currency listed. Its job is to tell you the price of the base currency. This is why it’s sometimes called the "counter currency." It is the amount of money you need to buy just one unit of the base currency.

Using our example, in the EUR/USD pair, the U.S. Dollar (USD) is the quote currency. If you see a price of 1.10, that number tells you that it costs you 1.10 U.S. Dollars to buy one Euro. That’s all there is to it. The number next to the currency pair is always the value of the quote currency.

It’s easy to get confused and ask, Quote vs base currency vs usd. People often wonder which one the U.S. Dollar is. The simple answer is that the USD can be either the base or the quote currency, depending on the pair. For example:

In EUR/USD, the USD is the quote currency.

But in USD/JPY, the USD is the base currency.

The position of the currency in the pair is the only thing that decides if it is the base or the quote. It does not matter what the currency itself is.

Using our example, in the EUR/USD pair, the U.S. Dollar (USD) is the quote currency. If you see a price of 1.10, that number tells you that it costs you 1.10 U.S. Dollars to buy one Euro. That’s all there is to it. The number next to the currency pair is always the value of the quote currency.

It’s easy to get confused and ask, Quote vs base currency vs usd. People often wonder which one the U.S. Dollar is. The simple answer is that the USD can be either the base or the quote currency, depending on the pair. For example:

In EUR/USD, the USD is the quote currency.

But in USD/JPY, the USD is the base currency.

The position of the currency in the pair is the only thing that decides if it is the base or the quote. It does not matter what the currency itself is.

Why the Difference Between Base and Quote Currency Matters

You might be thinking, "This seems so simple, why is it so important?" Well, this core concept is the starting point for everything you do as a trader.

For starters, it helps you know what you are actually buying and selling. If you are looking at base vs quote currency in the USD/JPY pair, you know that when you click "buy," you are buying the U.S. Dollar and selling the Japanese Yen. This keeps your trading decisions organized and clear.

It also affects how you measure profits and losses. A trade's value is always measured in the quote currency. For instance, if you trade EUR/USD, your profit or loss is in U.S. Dollars because the USD is the quote currency. This is a key part of the equation that tells you how much money you’ve made or lost.

For starters, it helps you know what you are actually buying and selling. If you are looking at base vs quote currency in the USD/JPY pair, you know that when you click "buy," you are buying the U.S. Dollar and selling the Japanese Yen. This keeps your trading decisions organized and clear.

It also affects how you measure profits and losses. A trade's value is always measured in the quote currency. For instance, if you trade EUR/USD, your profit or loss is in U.S. Dollars because the USD is the quote currency. This is a key part of the equation that tells you how much money you’ve made or lost.

Quick Reference Table

| Pair | Base Currency | Quote Currency | Meaning (Price = 1.25) |

| EUR/USD | EUR | USD | 1 EUR = 1.25 USD |

| USD/JPY | USD | JPY | 1 USD = 125 JPY |

| GBP/USD | GBP | USD | 1 GBP = 1.25 USD |

Why the Difference Between Base and Quote Currency Matters

You might be thinking, "This seems so simple, why is it so important?" Well, this core concept is the starting point for everything you do as a trader.

For starters, it helps you know what you are actually buying and selling. If you are looking at base vs quote currency in the USD/JPY pair, you know that when you click "buy," you are buying the U.S. Dollar and selling the Japanese Yen. This keeps your trading decisions organized and clear.

It also affects how you measure profits and losses. A trade's value is always measured in the quote currency. For instance, if you trade EUR/USD, your profit or loss is in U.S. Dollars because the USD is the quote currency. This is a key part of the equation that tells you how much money you’ve made or lost.

Example:

For starters, it helps you know what you are actually buying and selling. If you are looking at base vs quote currency in the USD/JPY pair, you know that when you click "buy," you are buying the U.S. Dollar and selling the Japanese Yen. This keeps your trading decisions organized and clear.

It also affects how you measure profits and losses. A trade's value is always measured in the quote currency. For instance, if you trade EUR/USD, your profit or loss is in U.S. Dollars because the USD is the quote currency. This is a key part of the equation that tells you how much money you’ve made or lost.

Example:

- EUR/USD = 1.25 means 1 euro = 1.25 US dollars.

- USD/EUR = 0.80 means 1 US dollar = 0.80 euros.

When is USD the Base or Quote?

When you see a pair like EUR/USD, GBP/USD, or AUD/USD, the U.S. Dollar is the quote currency. It's the "price tag." These are often called "USD pairs."

However, when you see a pair like USD/JPY, USD/CAD, or USD/CHF, the U.S. Dollar is the base currency. In these cases, you are looking at the price of one U.S. Dollar in terms of the other currency. This is where the term quote vs base currency vs usd comes in. The position of the USD matters a lot, and it’s the first thing you need to check before you make a trade.

Examples:

However, when you see a pair like USD/JPY, USD/CAD, or USD/CHF, the U.S. Dollar is the base currency. In these cases, you are looking at the price of one U.S. Dollar in terms of the other currency. This is where the term quote vs base currency vs usd comes in. The position of the USD matters a lot, and it’s the first thing you need to check before you make a trade.

Examples:

- EUR/USD – Base: EUR, Quote: USD

- USD/JPY – Base: USD, Quote: Japanese yen

- GBP/USD – Base: British pound, Quote: USD

- AUD/USD – Base: Australian dollar, Quote: USD

The Smallest Movement: Pips and Their Connection

Tiny changes in a currency pair's price are called pips (percentage in point). For most pairs, a pip is the fourth number after the decimal point. For example, a move from EUR/USD 1.1050 to 1.1051 is a one-pip movement. These small changes are what accumulate into profits or losses in forex trading.

Summary and Conclusion

Learning the difference between the base currency vs quote currency is a fundamental step for anyone interested in forex. It's not a complicated idea, but it’s the foundation for everything else you will learn.

Just remember this simple summary:

By keeping these two roles straight, you can read any currency pair, understand what a price change means, and begin to make smarter trading decisions. The world of forex is an exciting place, and knowing these basics will give you a big advantage as you continue to learn and grow as a trader.

Just remember this simple summary:

- The base currency is the first one listed. It's the one you're buying or selling. Its value is always one.

- The quote currency is the second one listed. It shows you the price of the base currency.

By keeping these two roles straight, you can read any currency pair, understand what a price change means, and begin to make smarter trading decisions. The world of forex is an exciting place, and knowing these basics will give you a big advantage as you continue to learn and grow as a trader.

LITFX Academy is the ultimate trading education platform, helping traders master Support & Resistance, refine risk management, and build confidence in the markets. Learn from real-world strategies, live coaching, and a thriving community of traders just like you!

Disclaimer: The content provided by LITFX Academy is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Trading involves risk, and past performance is not indicative of future results. Always do your own research and consult with a licensed financial professional before making any financial decisions.

Disclaimer: The content provided by LITFX Academy is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Trading involves risk, and past performance is not indicative of future results. Always do your own research and consult with a licensed financial professional before making any financial decisions.

© 2025 LITFX Academy. All Rights Reserved.