Forex Currency Pairs Explained: A Beginner's Guide to Major, Minor, and Exotic Pairs

Aug 1

/

LITFX Academy Staff

If you've already read our beginner guide on What is Forex Trading?, you're one step closer to understanding how the market works. Now, it’s time to explore one of the most important parts of forex currency pairs.

Forex trading is different from other markets because you’re always trading one currency against another. That’s why learning about forex currency pairs is a must for anyone who wants to trade the smart way. Now, this guide will map out everything you need to know from the basics to the different types of pairs you'll see on a trading platform.

Forex trading is different from other markets because you’re always trading one currency against another. That’s why learning about forex currency pairs is a must for anyone who wants to trade the smart way. Now, this guide will map out everything you need to know from the basics to the different types of pairs you'll see on a trading platform.

Key Takeaways

- Forex currency pairs are the core of trading, always involving two currencies traded against each other.

- A pair includes a base currency and a quote currency, showing how much of one is needed to buy the other.

- Major pairs include the USD, minor pairs don’t, and exotic pairs combine major currencies with those from emerging economies.

What Are Currency Pairs in Forex?

In forex, you never trade a single currency on its own. Instead, you trade it in relation to another. This is what we call a currency pair.

Think of it like this: if you’re buying apples with dollars, you’re comparing the value of apples to the dollar. In forex, if you’re trading the euro against the US dollar, you’re comparing the euro to the dollar's value.

At its simplest, a forex currency pair is just a way to show the value of one currency compared to another.

Each pair has two parts:

Think of it like this: if you’re buying apples with dollars, you’re comparing the value of apples to the dollar. In forex, if you’re trading the euro against the US dollar, you’re comparing the euro to the dollar's value.

At its simplest, a forex currency pair is just a way to show the value of one currency compared to another.

Each pair has two parts:

- The Base Currency: This is the first currency listed in the pair. It's the "foundation" or the main currency you are either buying or selling.

- The Quote Currency: This is the second currency listed. It's used to "quote" or give the value of the base currency.

Let’s look at a famous example, the EUR/USD pair. In this pair, the Euro (EUR) is the base currency, and the U.S. Dollar (USD) is the quote currency. The price you see for this pair tells you how many U.S. Dollars it takes to buy one single Euro. So, if the price is 1.0700, it means it costs $1.0700 to buy one Euro.

Understanding how currency pairs work is the first big step in trading. When you "buy" a pair like EUR/USD, you are really buying the base currency (the EUR) and selling the quote currency (the USD) at the same time. You are betting that the Euro will become stronger compared to the U.S. Dollar. If you "sell" the same pair, you are doing the opposite. You are selling the Euro and buying the U.S. Dollar, hoping the Euro will get weaker.

Understanding how currency pairs work is the first big step in trading. When you "buy" a pair like EUR/USD, you are really buying the base currency (the EUR) and selling the quote currency (the USD) at the same time. You are betting that the Euro will become stronger compared to the U.S. Dollar. If you "sell" the same pair, you are doing the opposite. You are selling the Euro and buying the U.S. Dollar, hoping the Euro will get weaker.

Explore our guide on the difference between base and quote currency and quickly master how to read forex pairs with confidence.

How Currency Pairs Work

Now that you know what a currency pair is, let’s learn how currency pairs work.

When you see a currency pair, you're looking at how much of the quote currency it takes to buy one unit of the base currency. Prices move up or down depending on global news, interest rates, and supply and demand.

Here’s what else plays a role:

Pips: This stands for “percentage in point.” It's how small price changes are measured. Most pairs are priced to four decimal places. A move from 1.1000 to 1.1001 is one pip.

Spreads: This is the difference between the buying (ask) price and the selling (bid) price. Tight spreads usually mean more liquidity and lower costs.

Volatility: Some pairs move more than others during the day. These moves can create trading opportunities—but also come with more risk.

When you see a currency pair, you're looking at how much of the quote currency it takes to buy one unit of the base currency. Prices move up or down depending on global news, interest rates, and supply and demand.

Here’s what else plays a role:

Pips: This stands for “percentage in point.” It's how small price changes are measured. Most pairs are priced to four decimal places. A move from 1.1000 to 1.1001 is one pip.

Spreads: This is the difference between the buying (ask) price and the selling (bid) price. Tight spreads usually mean more liquidity and lower costs.

Volatility: Some pairs move more than others during the day. These moves can create trading opportunities—but also come with more risk.

Write your awesome label here.

The Three Main Types of Currency Pairs

To make things easier, all the different currency pairs in the world are sorted into three main groups. Knowing these groups helps you choose the right ones to trade, especially when you are just starting out.

Major Currency Pairs

The major pairs are the most traded currency combinations in the world. They include the US dollar (USD) on one side, paired with another strong global currency. These pairs are known for being more stable and having tighter spreads.

Here are some of the most common major pairs:

Here are some of the most common major pairs:

- EUR/USD – Euro vs US Dollar

- USD/JPY – US Dollar vs Japanese Yen

- GBP/USD – British Pound vs US Dollar

- AUD/USD – Australian Dollar vs US Dollar

- USD/CHF – US Dollar vs Swiss Franc

- USD/CAD – US Dollar vs Canadian Dollar

Explaining the Top 3

EUR/USD (Euro / U.S. Dollar): This is the king of all pairs. It represents the two biggest economies in the world, the European Union and the United States. Its massive trading volume means it has the tightest spreads and the highest liquidity, making it a favorite for new and experienced traders alike.

USD/JPY (U.S. Dollar / Japanese Yen): This is a very active pair, known for having smooth, long-term trends. It's often influenced by the difference in interest rates between the U.S. and Japan, as well as big economic news from both countries.

GBP/USD (British Pound / U.S. Dollar): Known as "Cable," this pair is famous for its fast and sudden price moves. It can be more volatile than the EUR/USD, which means it moves up and down a lot. While exciting, this can also make it a little more challenging for brand-new traders, so it's a good pair to watch and learn about.

Because they have high trading volume, these are often considered the best forex pairs for beginners. The price movement is usually smoother, and they’re widely covered in news and analysis.

USD/JPY (U.S. Dollar / Japanese Yen): This is a very active pair, known for having smooth, long-term trends. It's often influenced by the difference in interest rates between the U.S. and Japan, as well as big economic news from both countries.

GBP/USD (British Pound / U.S. Dollar): Known as "Cable," this pair is famous for its fast and sudden price moves. It can be more volatile than the EUR/USD, which means it moves up and down a lot. While exciting, this can also make it a little more challenging for brand-new traders, so it's a good pair to watch and learn about.

Because they have high trading volume, these are often considered the best forex pairs for beginners. The price movement is usually smoother, and they’re widely covered in news and analysis.

Minor Currency Pairs

Now that you’ve seen the majors, let’s move to the minor currency pairs. These are also known as cross currency pairs because they do not include the US dollar.

Instead, you might see combinations like:

Minors are still liquid, especially the ones with the euro, pound, or yen. However, they usually have a slightly wider spread and may move in more unpredictable ways. This makes them better for traders who have a little more experience.

Instead, you might see combinations like:

- EUR/GBP – Euro vs British Pound

- GBP/JPY – British Pound vs Japanese Yen

- AUD/NZD – Australian Dollar vs New Zealand Dollar

Minors are still liquid, especially the ones with the euro, pound, or yen. However, they usually have a slightly wider spread and may move in more unpredictable ways. This makes them better for traders who have a little more experience.

Exotic Currency Pairs

Exotic pairs are made up of a major currency combined with a currency from a developing or smaller economy. These might include countries from Asia, Africa, Eastern Europe, or Latin America.

Some examples:

1. USD/TRY – US Dollar vs Turkish Lira

2. EUR/ZAR – Euro vs South African Rand

3. USD/SEK – US Dollar vs Swedish Krona

These pairs are less liquid, meaning fewer people trade them. That can lead to larger spreads and higher volatility. While they can offer big moves, they also come with bigger risks.

As a general rule, exotic pairs aren’t ideal for beginners. But knowing about them can help you understand how broad the forex market really is.

Not all currency pairs move the same way throughout the day. Some are more active in certain market hours, which affects how they behave. Knowing the best time to trade helps you catch the right moves and avoid slow periods.

Some examples:

1. USD/TRY – US Dollar vs Turkish Lira

2. EUR/ZAR – Euro vs South African Rand

3. USD/SEK – US Dollar vs Swedish Krona

These pairs are less liquid, meaning fewer people trade them. That can lead to larger spreads and higher volatility. While they can offer big moves, they also come with bigger risks.

As a general rule, exotic pairs aren’t ideal for beginners. But knowing about them can help you understand how broad the forex market really is.

Not all currency pairs move the same way throughout the day. Some are more active in certain market hours, which affects how they behave. Knowing the best time to trade helps you catch the right moves and avoid slow periods.

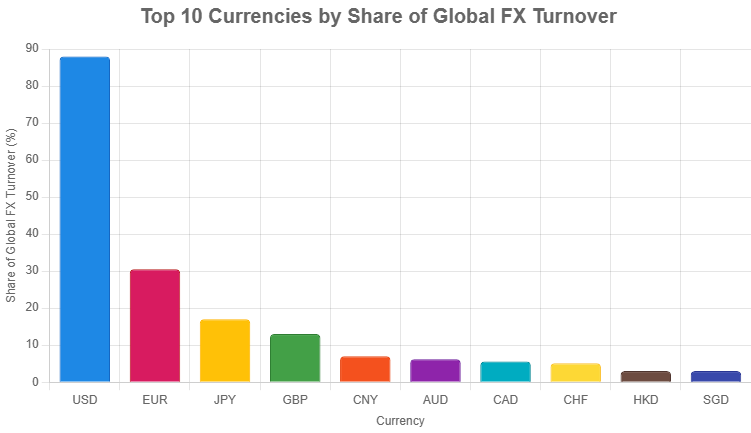

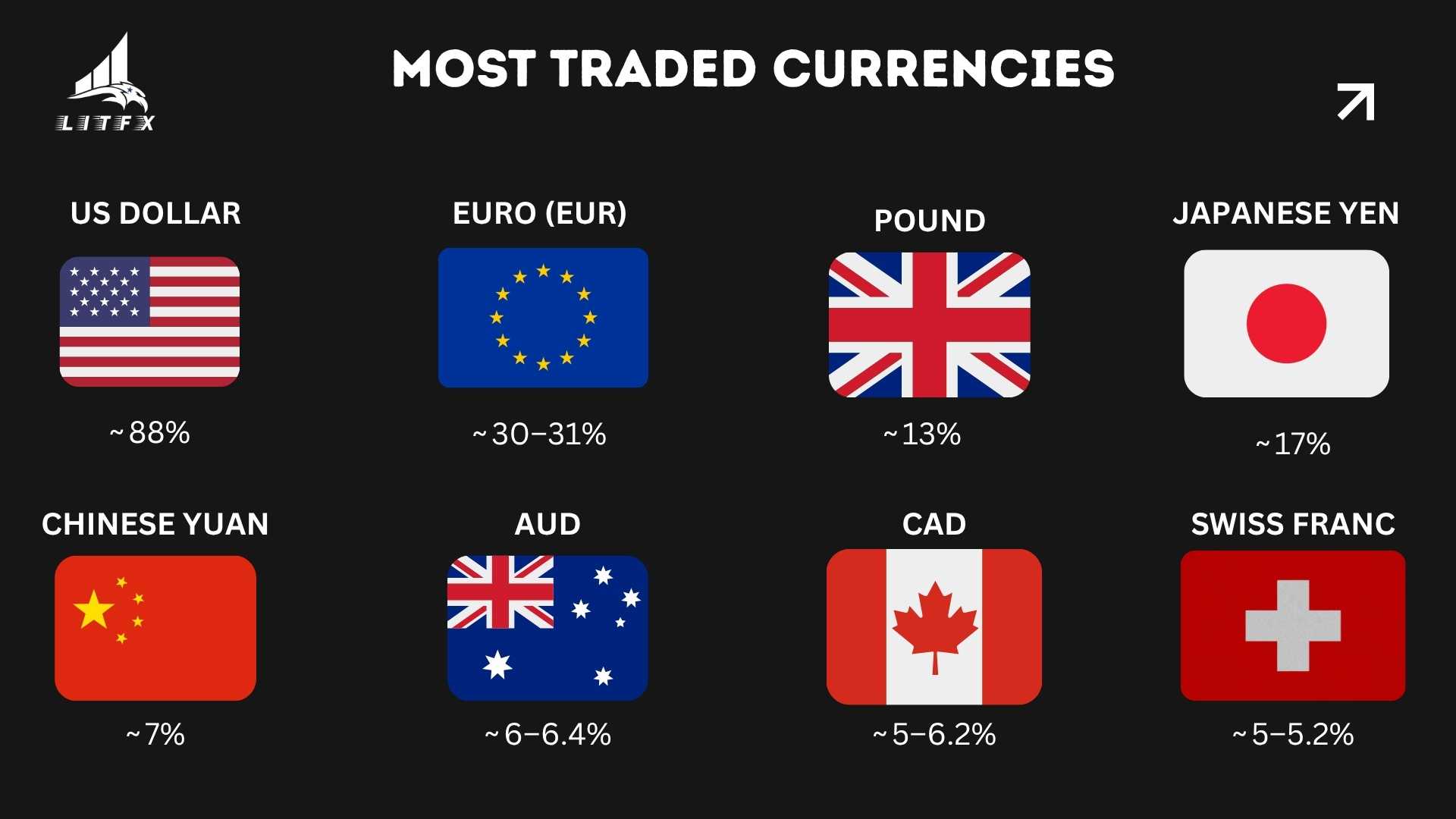

Top 10 Most Traded Currencies in 2025

| Rank | Currency (Code) | Share of Global FX Turnover |

| 1 | U.S. Dollar (USD) | ~ 88% |

| 2 | Euro (EUR) | ~ 30–31% |

| 3 | Japanese Yen (JPY) | ~ 17% |

| 4 | British Pound (GBP) | ~ 13% |

| 5 | Chinese Yuan / Renminbi (CNY) | ~ 7% |

| 6 | Australian Dollar (AUD) | ~ 6–6.4% |

| 7 | Canadian Dollar (CAD) | ~ 5–6.2% |

| 8 | Swiss Franc (CHF) | ~ 5–5.2% |

| 9 | Hong Kong Dollar (HKD) | ~ 3% |

| 10 | Singapore Dollar (SGD) | ~ 2–4% |

The Best Currency Pairs for Beginners

If you’re just starting out, keep it simple. Not all pairs are created equal when it comes to learning.

Here’s what to look for in the easiest currency pairs to trade:

Some great choices include:

Here’s what to look for in the easiest currency pairs to trade:

- High liquidity (lots of buyers and sellers)

- Tight spreads (low cost to enter trades)

- Wide availability of news and analysis

Some great choices include:

- EUR/USD – Most traded pair, very stable

- GBP/USD – Strong price movements, clear trends

- USD/JPY – Liquid and often less volatile

These are often labeled forex pairs for beginners because they are easier to understand, track, and practice with on a demo account.

If you're just starting out, it's smart to first learn forex trading through a clear step-by-step approach before moving to more complex pairs.

If you're just starting out, it's smart to first learn forex trading through a clear step-by-step approach before moving to more complex pairs.

Get Started Today

If you want real guidance from someone who truly understands the markets, don’t miss the chance to learn directly from expert mentor Farrukh. Join LITFX Academy today and start your forex journey with the right education, expert support, and a trading community that wants to see you grow. Get full access to premium trading courses, weekly Zoom sessions, a private Discord group, and one-on-one live discussions designed to help you trade with clarity and confidence.

How to Read a Currency Pair Quote

When you look at a currency pair on a trading platform, you will usually see two prices: a "bid" price and an "ask" price.

The small difference between these two prices is the spread, which is a cost to you for making the trade. For major pairs like EUR/USD, this spread might be only a few tiny units.

These tiny units are called pips, or "percentage in point." A pip is the smallest possible price change in a currency pair. For most pairs, it's the fourth number after the decimal point. So, if the EUR/USD goes from 1.0700 to 1.0701, that is a one-pip movement.

Fortunately, you don't need to do any complex math to see this. Your trading platform will show you the spread and how many pips a trade has moved. But understanding what a pip is will help you measure your profits and losses in a trade.

- The Bid Price is what a buyer is willing to pay for the base currency. It's the price you would sell at.

- The Ask Price is what a seller is asking for the base currency. It's the price you would buy at.

The small difference between these two prices is the spread, which is a cost to you for making the trade. For major pairs like EUR/USD, this spread might be only a few tiny units.

These tiny units are called pips, or "percentage in point." A pip is the smallest possible price change in a currency pair. For most pairs, it's the fourth number after the decimal point. So, if the EUR/USD goes from 1.0700 to 1.0701, that is a one-pip movement.

Fortunately, you don't need to do any complex math to see this. Your trading platform will show you the spread and how many pips a trade has moved. But understanding what a pip is will help you measure your profits and losses in a trade.

Why Liquidity and Volatility Matter

Two words that come up a lot in forex are liquidity and volatility.

Liquidity means how easily a pair can be bought or sold. Major pairs are the most liquid.

Volatility is how much a pair’s price moves. Pairs with high volatility can offer big rewards but also carry more risk.

If you’re a beginner, it’s wise to choose pairs that are both liquid and have moderate volatility. This is one reason many traders prefer forex vs stocks — forex markets offer more continuous action across global sessions.

Liquidity means how easily a pair can be bought or sold. Major pairs are the most liquid.

Volatility is how much a pair’s price moves. Pairs with high volatility can offer big rewards but also carry more risk.

If you’re a beginner, it’s wise to choose pairs that are both liquid and have moderate volatility. This is one reason many traders prefer forex vs stocks — forex markets offer more continuous action across global sessions.

Final Thoughts

You now have a solid understanding of the most important concepts for forex currency pairs. We've explored what they are, what the different types mean for you, and what makes their prices change.

Remember, the goal is to choose the right pairs to trade based on your knowledge and comfort level. Starting with major pairs is the smart choice. With this knowledge, you are taking a confident first step into the exciting world of trading currency pairs. Now you can begin to watch the market and learn more about how these pairs move and why.

Remember, the goal is to choose the right pairs to trade based on your knowledge and comfort level. Starting with major pairs is the smart choice. With this knowledge, you are taking a confident first step into the exciting world of trading currency pairs. Now you can begin to watch the market and learn more about how these pairs move and why.

LITFX Academy is the ultimate trading education platform, helping traders master Support & Resistance, refine risk management, and build confidence in the markets. Learn from real-world strategies, live coaching, and a thriving community of traders just like you!

Disclaimer: The content provided by LITFX Academy is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Trading involves risk, and past performance is not indicative of future results. Always do your own research and consult with a licensed financial professional before making any financial decisions.

Disclaimer: The content provided by LITFX Academy is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Trading involves risk, and past performance is not indicative of future results. Always do your own research and consult with a licensed financial professional before making any financial decisions.

© 2025 LITFX Academy. All Rights Reserved.