What is a Lot in Forex and Lot Sizes?

Aug 11

Trading in the forex market involves a great deal of nuance and careful decision-making. One of the most fundamental concepts for any trader to master is the forex lot size. This isn't just a simple technical term; it's the core tool for managing risk, protecting your capital, and ensuring you can trade for the long haul. A deep understanding of lot sizes can turn a potentially chaotic trading experience into a calculated, disciplined process. This guide provides a clear and comprehensive look at lot sizes, their different types, and how to use them effectively.

What Is a Lot in Forex?

In forex trading, a lot is the size of your trade. It tells you how many units of a currency you are buying or selling. Instead of saying, “I’m buying 10,000 euros,” traders say, “I’m trading one mini lot of EUR/USD.”

Since currency prices are measured in tiny increments called pips, trading single units of currency would result in profits or losses that are too small to be meaningful. Lots allow traders to transact in larger, pre-defined bundles of currency.

By using lots, a trader's exposure to the market is increased, making the value of each pip movement significant. When a trader opens a position, they are not buying one dollar or one euro, but a specific volume of currency, and that volume is measured in lots. The size of this lot directly determines the trade's risk and reward potential.

Since currency prices are measured in tiny increments called pips, trading single units of currency would result in profits or losses that are too small to be meaningful. Lots allow traders to transact in larger, pre-defined bundles of currency.

By using lots, a trader's exposure to the market is increased, making the value of each pip movement significant. When a trader opens a position, they are not buying one dollar or one euro, but a specific volume of currency, and that volume is measured in lots. The size of this lot directly determines the trade's risk and reward potential.

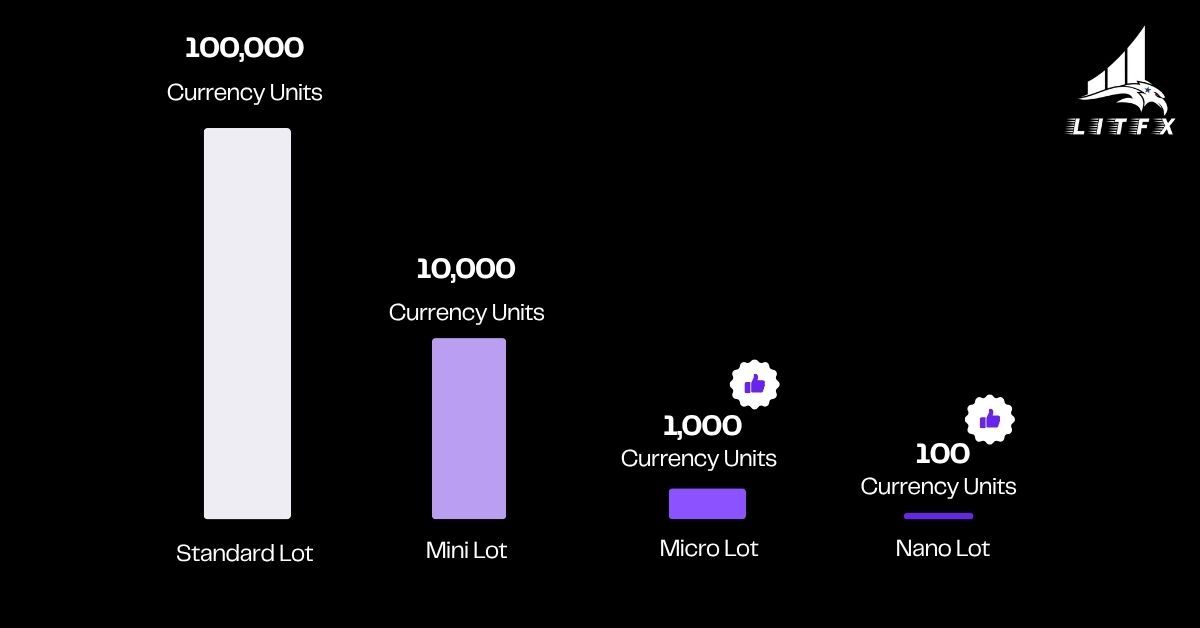

Types of Forex Lots

Forex lot sizes are categorized into four main types. Each size represents a different number of currency units, allowing traders to choose a volume that fits their specific account size and risk tolerance. Understanding these differences is crucial for a complete lot size comparison.

Standard Lot in Forex

A standard lot in forex equals 100,000 units of the base currency. For example, trading one standard lot of EUR/USD means controlling 100,000 euros. Standard lots are the largest trade size and are often used by professional traders and large institutions.

With a standard lot, a one-pip movement in most major currency pairs is valued at approximately $10. This substantial pip value can lead to significant profits, but it also carries the highest level of risk. A small market move against a position can quickly result in a large financial loss.

With a standard lot, a one-pip movement in most major currency pairs is valued at approximately $10. This substantial pip value can lead to significant profits, but it also carries the highest level of risk. A small market move against a position can quickly result in a large financial loss.

Mini Lots

A mini lot is a trade of 10,000 units of the base currency, which is one-tenth the size of a standard lot. Trading a mini lot of EUR/USD means controlling 10,000 euros. The pip value for a mini lot is typically around $1.Normal text.

Mini lots are often used by retail traders who have a moderate amount of capital. They offer a good middle ground, providing a balance between the high risk of a standard lot and the lower potential returns of a micro lot.

Mini lots are often used by retail traders who have a moderate amount of capital. They offer a good middle ground, providing a balance between the high risk of a standard lot and the lower potential returns of a micro lot.

Micro Lots

A micro lot is a trade of 1,000 units of the base currency. This is one-tenth the size of a mini lot. In a trade of a micro lot of EUR/USD, a trader controls 1,000 euros. The pip value for a micro lot is approximately $0.10, or 10 cents.

The low risk of micro lots makes them an excellent choice for beginners and traders with smaller accounts. This size is ideal for practicing strategies and getting familiar with market movements without risking a substantial amount of money. The forex lot size for beginners is almost always a micro lot.

The low risk of micro lots makes them an excellent choice for beginners and traders with smaller accounts. This size is ideal for practicing strategies and getting familiar with market movements without risking a substantial amount of money. The forex lot size for beginners is almost always a micro lot.

Nano Lots

The smallest lot size available, a nano lot, represents 100 units of the base currency. A one-pip movement with a nano lot has a value of about $0.01. Nano lots are not offered by every broker, but they are a fantastic tool for practicing with minimal financial risk. They can serve as a stepping stone from a demo account to live trading with real money.

Ready to elevate your trading Skills?

Start Trading With LITFX Academy Live Classes

Micro Lot vs Standard Lot

A micro lot in forex is 1,000 units of currency, while a standard lot is 100,000 units. The difference in size has a big impact on risk and profit.

Standard lots offer higher profit potential but carry much greater risk. Micro lots allow slower, safer growth and more room to learn.

- Standard lot – Each pip is worth about $10. A 10-pip move equals roughly $100 gain or loss. Suitable for experienced traders with larger accounts.

- Micro lot – Each pip is worth about $0.10. A 10-pip move equals roughly $1 gain or loss. Ideal for beginners or small accounts.

Standard lots offer higher profit potential but carry much greater risk. Micro lots allow slower, safer growth and more room to learn.

Choosing the Right Lot Size

Selecting the correct forex lot size is not a matter of guesswork; it's a critical part of risk management. The appropriate size for a trader depends on their account size, risk tolerance, and the specific trade's stop-loss level. Here is a step-by-step method to determine the right lot size.

Define Your Account Size

The first step is to know the total amount of money in your trading account. This number is your capital, and all risk calculations will be based on it.

Determine Risk Per Trade

A common rule is to never risk more than 1% to 2% of your total account balance on a single trade. This protects your capital from significant losses. If your account size is $2,000 and you risk 1%, your total risk amount is $20 per trade.

Identify Your Stop-Loss in Pips

Before entering a trade, a trader should have a clear stop-loss level. This is the price point where the trade will automatically close to limit losses. The distance between your entry price and this stop-loss price is measured in pips. Let's assume a stop-loss distance of 40 pips.

4. Calculate the Lot Size

Now you can calculate the precise lot size. The goal is to choose a lot size where a 40-pip loss does not exceed your $20 risk amount.

Here's a simple way to think about the calculation:

For a micro lot, a 40-pip loss would be $4 (40 pips * $0.10). This is well within your $20 risk limit. In fact, you could trade up to five micro lots. A mini lot, with a pip value of $1, would result in a $40 loss, which is more than your risk limit. Therefore, the appropriate size for this trade is a micro lot, or a combination of micro lots up to five. This method provides a disciplined and scientific answer to how to choose lot size correctly.

- Total Risk Amount: $20

- Stop-Loss in Pips: 40 pips

- Pip Value for a micro lot: $0.10

For a micro lot, a 40-pip loss would be $4 (40 pips * $0.10). This is well within your $20 risk limit. In fact, you could trade up to five micro lots. A mini lot, with a pip value of $1, would result in a $40 loss, which is more than your risk limit. Therefore, the appropriate size for this trade is a micro lot, or a combination of micro lots up to five. This method provides a disciplined and scientific answer to how to choose lot size correctly.

Lot Size Comparison Table

| Lot Type | Units | Pip Value (USD) | Best For |

| Standard | 100,000 | $10 | Advanced traders, large accounts |

| Mini | 10,000 | $1 | Intermediate traders |

| Micro | 1,000 | $0.10 | Beginners, low risk |

| Nano | 100 | $0.01 | Testing strategies |

Why Lot Size Matters More Than You Think

Many traders focus on finding the “perfect” entry point or the “right” indicator. But even if your trade direction is correct, the wrong lot size can wipe you out. A big trade without enough room to breathe will hit your stop-loss before the market even has a chance to move in your favor.

Lot size is your defense. It’s how you control the damage when things go wrong and how you protect your account for the long term.

Lot size is your defense. It’s how you control the damage when things go wrong and how you protect your account for the long term.

Golden Advice on Lot Sizes by Farrukh Otajonov

After 6 Years in this business, here’s my advice:

Always start small, even if you feel confident.

Increase your lot size gradually as your skills and account grow.

Never risk money you can’t afford to lose.

Focus on staying in the game. Longevity in trading is more important than one big win.

Always start small, even if you feel confident.

Increase your lot size gradually as your skills and account grow.

Never risk money you can’t afford to lose.

Focus on staying in the game. Longevity in trading is more important than one big win.

How Can I Start Trading Forex?

Starting in forex trading is easier than most people think, but it’s important to begin the right way. You’ll need a trading account with a trusted broker, a basic understanding of how currency pairs work, and a clear plan for managing your risk. Before you dive in, it’s worth taking the time to learn the basics so you can trade with confidence instead of guessing.

One of the best ways to get started is by joining LITFX Academy, where you can learn to trade forex online alongside experienced mentors. We offer step-by-step courses, live classes, and weekly Zoom sessions that guide you from beginner to confident trader. You’ll also get access to our live mentorship program led by Farrukh Otajonov, CEO of LITFX, and join a private Discord group where traders share strategies, market updates, and trade ideas every day.

One of the best ways to get started is by joining LITFX Academy, where you can learn to trade forex online alongside experienced mentors. We offer step-by-step courses, live classes, and weekly Zoom sessions that guide you from beginner to confident trader. You’ll also get access to our live mentorship program led by Farrukh Otajonov, CEO of LITFX, and join a private Discord group where traders share strategies, market updates, and trade ideas every day.

This video provides a detailed look at a backtested trading strategy, revealing surprising results and a high win rate.

Psychology and Lot Sizing

The size of a forex trade has a powerful effect on a trader's mindset. Using a lot size that is too large for an account can lead to immense stress and anxiety, causing emotional decisions like closing winning trades too early or holding onto losing ones for too long. This emotional trading is a direct path to failure. By using a small, appropriate lot size, such as a micro lot, a trader can maintain a calm and clear mind. This stability allows for disciplined trading and focusing on long-term success rather than the fear of a single loss.

LITFX Academy is the ultimate trading education platform, helping traders master Support & Resistance, refine risk management, and build confidence in the markets. Learn from real-world strategies, live coaching, and a thriving community of traders just like you!

Disclaimer: The content provided by LITFX Academy is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Trading involves risk, and past performance is not indicative of future results. Always do your own research and consult with a licensed financial professional before making any financial decisions.

Disclaimer: The content provided by LITFX Academy is for educational and informational purposes only. It does not constitute financial, investment, or trading advice. Trading involves risk, and past performance is not indicative of future results. Always do your own research and consult with a licensed financial professional before making any financial decisions.

© 2025 LITFX Academy. All Rights Reserved.